JULY -AUGUST 2025 REOPENED INFRASTRUCTURE BONDS

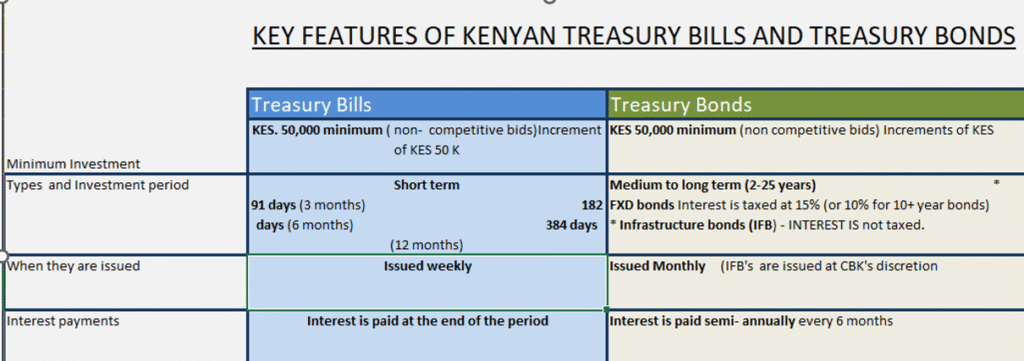

A Treasury Bond is a medium to long term debt instrument issued by the Central Bank of Kenya on behalf on the national Treasury. In the financial budget 25/26 the government set out raise an estimated 635 billion from domestic borrowing. Government securities are considered safe and reliable investment products due to their unique features including safety, returns and liquidity. They are often a cornerstone investment portfolio due to their reliability and role as a stable source of income and capital preservation.

In the month of July-August the government has reopened two Infrastructure Bonds IFB1/2018/015 and IFB1/2022/19.

Who can Invest

Investors who wish to participate in the IFB Bonds auction must have an active CSD account at the Central Bank of Kenya. Application is done on the Dhow CSD portal or app. Individuals can open a CSD account individually or jointly. Institutions and registered bodies can also open corporate CSD accounts.

Features of Government Securities

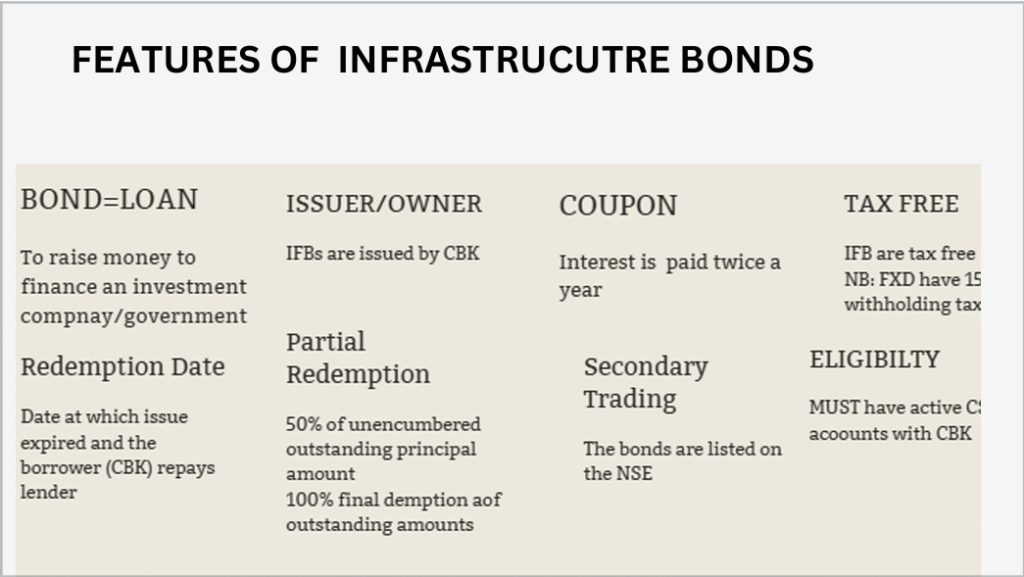

Features of Infrastructure Bonds (IFBs)

Fixed Coupon Rate -IFBs have a fixed interest payment (coupons). They are paid every 6 months

Tax Exempt- IFBS holders do not pay withholding tax on interest payments (coupons)

Amortized bonds – IFBs pay part of the initial capital during the term of the bond.

IFBs can be purchased either through the primary auction (from the issuer) or secondary market (from existing bondholders).

How to optimize your return on July -August Returns

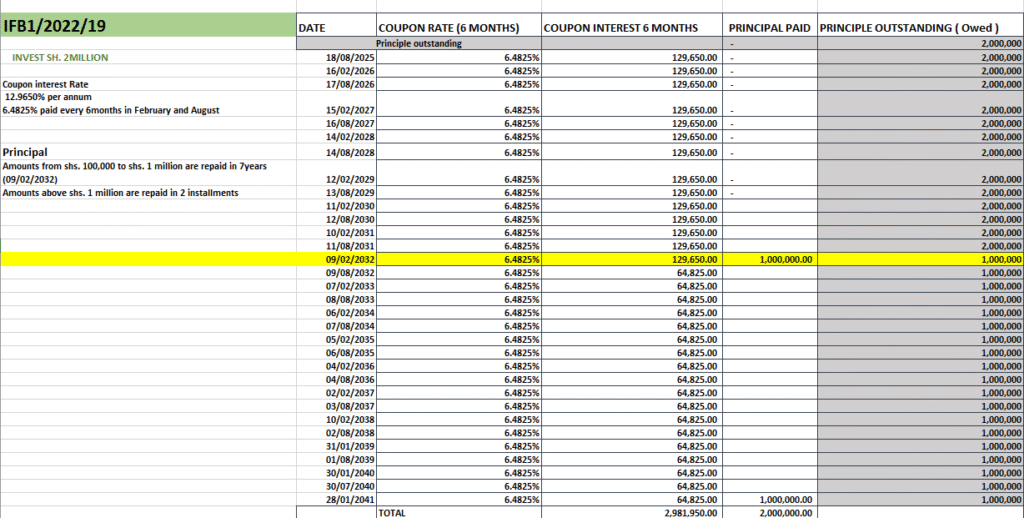

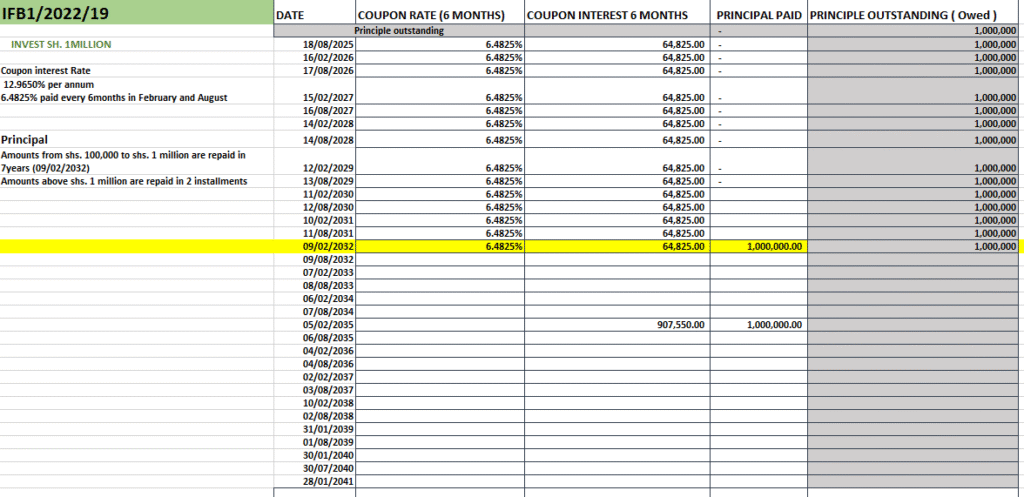

Say an investor decides to invest a face value of Kshs 2Million in the August reopened bond of IFB1/2022/19. This is a bond that was first issued in the year 2022 with a tenure of nineteen years. Investors have 15 years to continue enjoying coupons from this bond. The interest rate forIFB1/2022/19 is 12.9650%. So, on the 18th of August 2025, the investor will receive their first coupon of Kshs 129,650/= and thereby continue to receive the same amount every 6 months.

On 09/02/2032, the investor will receive 50% unencumbered outstanding principal amount which will be Kshs 1,000,000/= The new face value will be the remaining balance which will be Ksh 1,000,000 an also the coupon amount will be Kshs 64,825/=. The final redemption for the IFB1/2022/19 will be on 28/01/ 2041 where the investor will receive 100% of their outstanding amounts.

Now on the same bond IFB1/2022/19, if an investor decides to invest a face value of Kshs 1,000,000/=. Their investment structure will be totally different. This is because of the redemption structure of infrastructure bonds (IFBs). It states that any amounts up to Kshs 1.0 million per CSD account at amortization will be redeemed in full. So on 09/02/2032, the scheduled redemption date the investor will receive all their principal payment and final coupon.

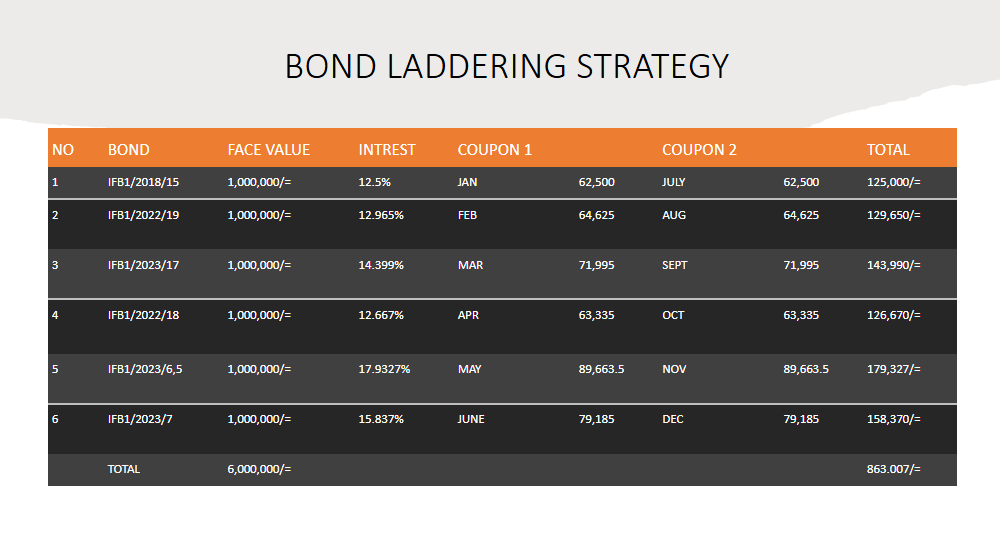

Bond Laddering Strategy

This means setting up a system whereby you are able to receive a coupon payment every month. The main feature of treasury bonds is that it pays coupons every 6 months

This is a risk-free way of setting up a structure to earn passive income.

This is a long-term strategy that requires a comprehensive analysis of your financials and it’s a not a one-day journey, but when established effectively it works very well.

Listed below is an example of a bond laddering strategy of six IFBs each with a face value of Kshs 1,000,000/=.

Also to maximize revenue, the investor should reinvest the coupons so that they earn compounding interest on their earnings.

Empowerment for Success in 2025

The event aimed to set participants on a path of success for the year ahead. By providing

them with the tools, strategies, and support necessary to achieve their goals, attendees

were empowered to make 2025 their most successful year yet.

Conclusion

The “Vision Board & Goal Setting Workshop” was a transformative experience, equipping individuals with the resources needed to visualize and pursue their dreams. By focusing on goal setting techniques, goal action plans, financial strategies (including treasury bills and bonds), community building, and expert advice, attendees were given a solid foundation to make meaningful progress in 2025. The final Q&A session helped participants leave with clarity and actionable insights. The vision board activities provided an engaging, hands-on experience that allowed each participant to deeply connect with their goals and start visualizing their success for the year ahead.

As the year progresses, the lessons and connections made during the workshop will undoubtedly serve as a guide to achieving success, both personally and professionally. Vision Board Creation & Activities

Participants were guided through the process of creating their personal vision boards, with structured activities designed to encourage self-reflection and goal clarity. These activities involved selecting images, quotes, and symbols that represented participants’ dreams, values, and objectives for the year ahead. The hands-on approach allowed attendees to connect deeply with their aspirations and visually map out their future.

Goal-Setting Strategies

Expert facilitators introduced proven techniques to help attendees set clear, actionable goals. The strategies provided were designed to break down long-term goals into manageable steps, ensuring that participants felt confident in their ability to make measurable progress throughout 2025.

Goal Action Plans

A crucial component of the workshop was the development of Goal Action Plans. Participants worked through actionable steps for each of their goals, defining specific actions, timelines, and resources needed to achieve them. This step-by-step approach ensured that goals were not only clear but also achievable within set timelines.

Treasury Bills and Bonds

A key segment of the workshop focused on Treasury Bills and Bonds, where expert financial advisors discussed the importance of investing in these government securities as a reliable method of building wealth. Participants learned how treasury bills and bonds work, their benefits, and how to include them in their financial planning to ensure long term financial security.

Positive Energy and Community Building

One of the core elements of the workshop was the creation of a supportive, like-minded community. Participants engaged in group activities and discussions, fostering an atmosphere of encouragement and positivity. This environment was essential for nurturing personal growth and motivating attendees to stay committed to their goals.

Expert Financial Guidance

In addition to treasury bills and bonds, facilitators provided valuable insights into managing personal finances and creating a sustainable financial plan. These strategies, particularly geared towards the Kenyan market, gave attendees practical tools for achieving their goals while ensuring financial stability.

Q&A Session

The workshop concluded with an interactive Q&A session, where participants had the opportunity to ask questions, clarify doubts, and seek advice from the experts. This session allowed for deeper engagement, helping attendees address personal challenges and refine their goal-setting approaches based on real-world experiences and insights.

Benefits of Attending

Connection with a Supportive Community, Attendees had the opportunity to network and form lasting connections with others who shared similar aspirations. This community proved to be a valuable resource for inspiration and mutual support.

Fostering a Positive Mindset

The workshop emphasized the importance of cultivating a mindset that supports personal and professional growth. Participants left with a renewed sense of optimism, ready to tackle challenges and turn their dreams into reality.